Posted on 29 September 2017

Towards a new era of petroleum refining

Over the last few decades, the refining industry has undergone major restructuring. The total number of refineries operated in the world has been reduced and currently totals approximately 640 installations (of which about 140 in the USA).

Over the last few decades, the refining industry has undergone major restructuring. The total number of refineries operated in the world has been reduced and currently totals approximately 640 installations (of which about 140 in the USA).

The refineries that have been most affected by this crisis are those that were designed to process specific crude oils (light and / or non-corrosive oils). The consequence of this lack of flexibility is a lower profitability. In addition to this, other constraints that are imposed on operators (e.g. operating costs, highly competitive market, environmental standards and product specifications, taxes, etc.) are limiting the potential profit per barrel of treated oil and therefor increasing the economic pressure on these refineries even more.

Being more flexible to process more and more complex crude oils

To increase the profitability of the refineries, many operators have initiated Operational Excellence (OpEx) initiatives aimed in particular at optimizing operating costs such as energy consumption, planned shutdown costs, etc. In this context, reducing the crude oil procurement costs is a substantial source of saving, given the fact that the purchase of crude oil accounts for approximately 80% of operating costs. Each margin point on oil supply therefore has a direct impact on the economic balance sheet of a refinery.

Extending supply scenarios to adapt to the market dynamics

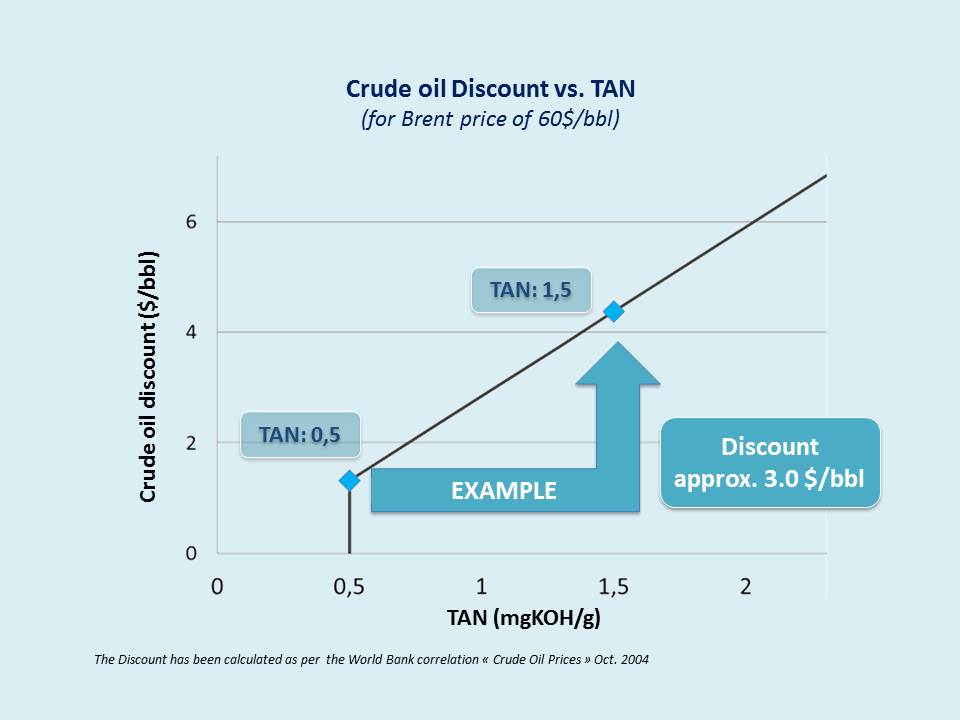

In order to offset the high volatility of oil prices and optimize margins, the refining community is unquestionably tempted to extend its supply scenarios by including ‘opportunity’ oils (heavy oil, high tan oil, etc.), or by increasing the share of these discounted oils in the crude slate, to increase profits. For example, an analysis of the World Bank shows a discount of more than $ 3 US per point of TAN and per barrel with a Brent price of $ 60 per barrel (ESMAP TECHNICAL PAPER 081: Crude Oil Price Differentials and Differences in Oil Qualities, October 2005). On the basis of these data, an increase of 0.5 in TAN could thus generate savings of approximately 1.5 million US $ / week for a supply volume of 150 000 bbl / day corresponding to a medium size refinery.

In order to offset the high volatility of oil prices and optimize margins, the refining community is unquestionably tempted to extend its supply scenarios by including ‘opportunity’ oils (heavy oil, high tan oil, etc.), or by increasing the share of these discounted oils in the crude slate, to increase profits. For example, an analysis of the World Bank shows a discount of more than $ 3 US per point of TAN and per barrel with a Brent price of $ 60 per barrel (ESMAP TECHNICAL PAPER 081: Crude Oil Price Differentials and Differences in Oil Qualities, October 2005). On the basis of these data, an increase of 0.5 in TAN could thus generate savings of approximately 1.5 million US $ / week for a supply volume of 150 000 bbl / day corresponding to a medium size refinery.