Posted on 17 July 2017

Tougher crude oils: a market reality

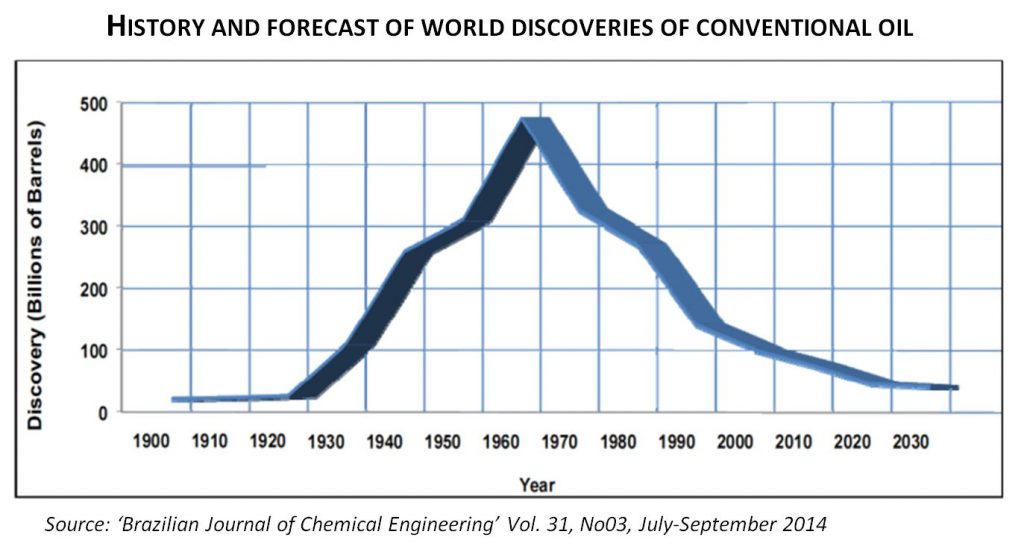

Over the last few decades, the oil market has changed dramatically. Indeed, the growing exploitation of new natural resources, in order to meet the ever increasing demand, leads to a diversification of the properties of produced hydrocarbons put on the market. In particular, the geographical distribution of petroleum explorations continues to expand, leading to a growing variety of crude oil characteristics. This tendency is now accentuated by the development and valorization of so-called “unconventional” hydrocarbons (e.g. extra-heavy oils, tar sands).

Over the last few decades, the oil market has changed dramatically. Indeed, the growing exploitation of new natural resources, in order to meet the ever increasing demand, leads to a diversification of the properties of produced hydrocarbons put on the market. In particular, the geographical distribution of petroleum explorations continues to expand, leading to a growing variety of crude oil characteristics. This tendency is now accentuated by the development and valorization of so-called “unconventional” hydrocarbons (e.g. extra-heavy oils, tar sands).

New crude oils, an ‘unconventional’ tendency

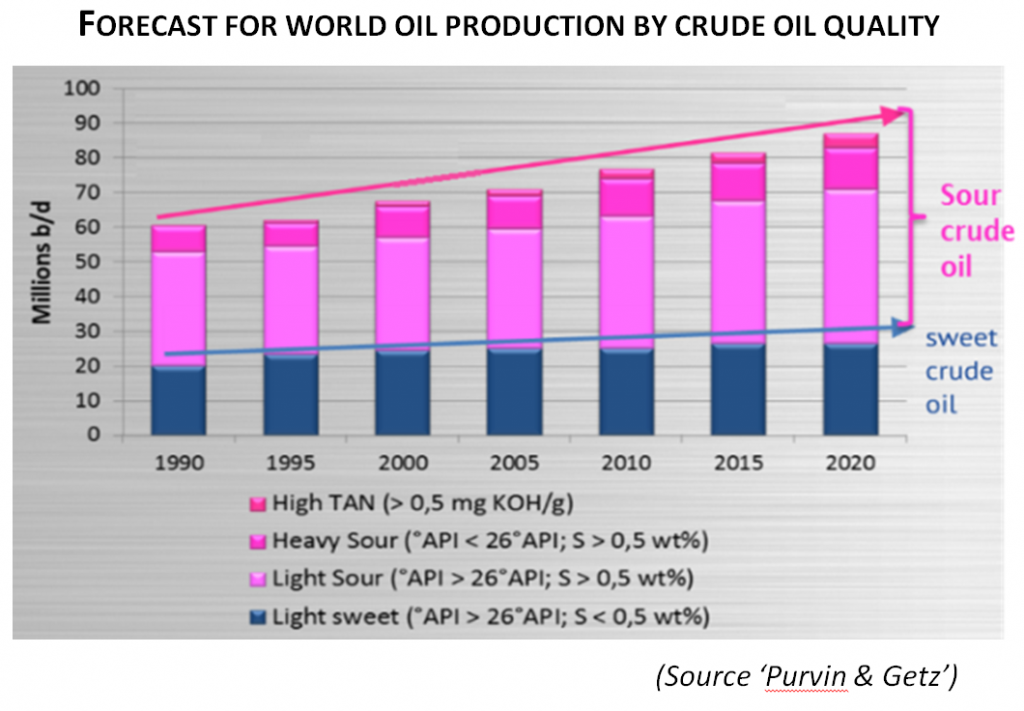

There are now over 150 different types of oils produced worldwide. The main parameters influencing the quality of an oil, and therefore its price, are sulfur content, density (API degrees) and (organic) acid content (TAN). High density, high levels of sulfur and TAN are synonymous with a reduced market value of an oil.

Against this backdrop of changes in the oil landscape, the market share of “HTS” (High Sulfur) oils continues to grow and now accounts for about 70% of the world production (North Sea, South, Russia, West Africa …). Generally speaking, the status of so-called “opportunity” oils (high sulfur or HTS oils, high organic acids or HAC oils, unconventional oils, etc.) evolves continuously, indicating a real transformation of the supply standards of refineries.

A major challenge for refiners

The oil refining community is fully aware of the undeniable evolution of the produced hydrocarbons put on the world market. To accommodate these changes, operators must identify the technological challenges and adaptations needed to process these more complex oils. Refineries, especially older ones, need to perform Audits to develop strategic action plans that can sometimes lead to major transformations in order to adapt to this dynamic environment and anticipate ever more demanding operating conditions.